Program helps low-to-moderate income families (LMI) make energy and weatherization improvements to their homes

Providence, RI (April 9, 2025) – Rhode Island-based Capital Good Fund is announcing a new loan program called HomeGreen for Massachusetts and Rhode Island residents who want to make energy-efficient home improvements but may not qualify for a loan through traditional means. Capital Good Fund is a nonprofit, U.S. Treasury-certified Community Development Financial Institution (CDFI) that provides equitable financial services to low-to-moderate income (LMI) individuals for a variety of key needs, including home energy-efficiency upgrades; security deposits; immigration expenses (citizenship applications, green card renewal, family petitions, etc.); and emergencies.

“We believe everyone, regardless of FICO score, should be able to make sustainability changes that save them money while making their homes more resilient, efficient, healthy, and comfortable,” says Capital Good Fund founder and CEO Andy Posner. Capital Good Fund is able to provide financing options for people with less-than-perfect credit because it is a nonprofit organization.

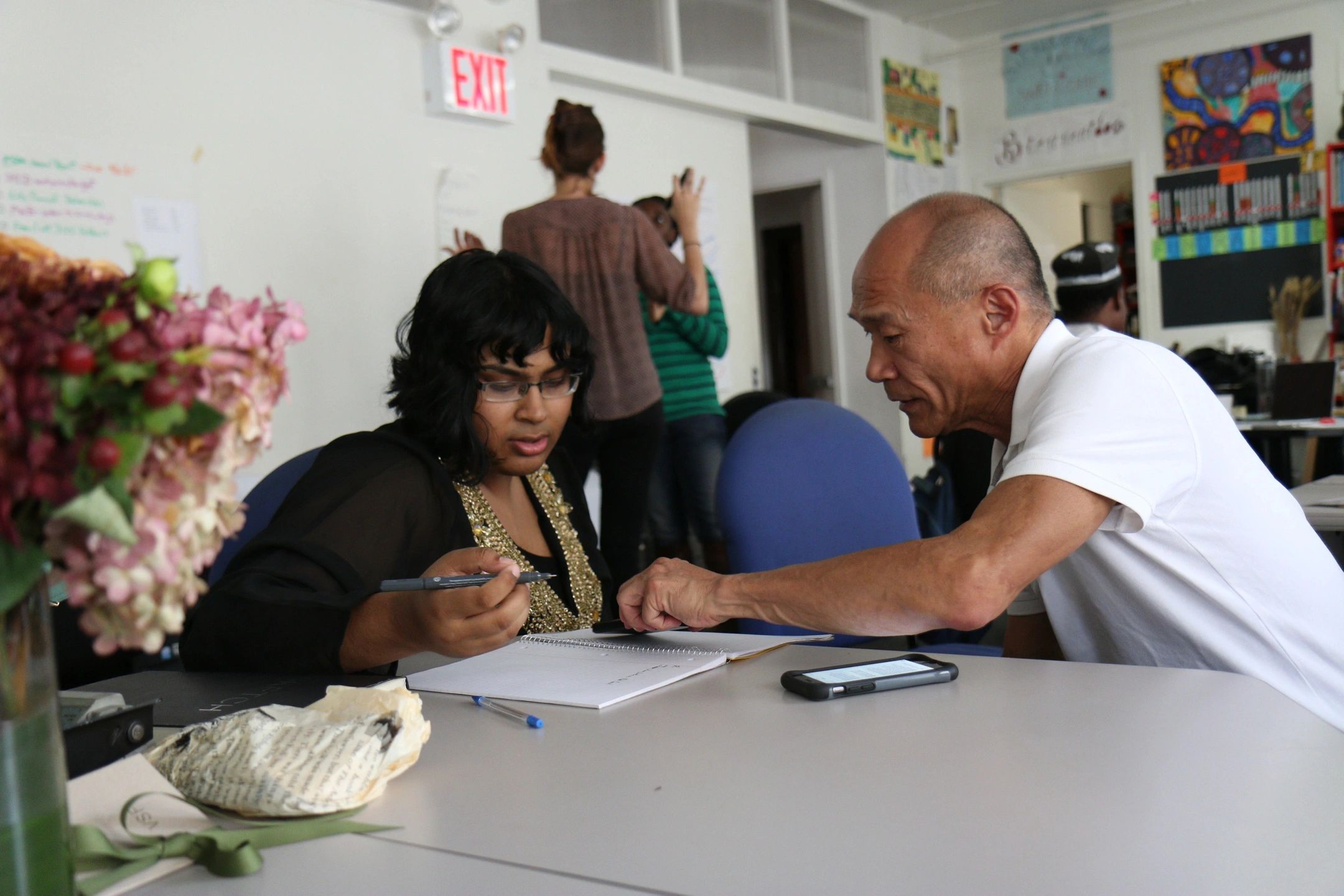

The HomeGreen Loan program has low, fixed rates, no fees, and terms of up to seven years on loans ranging from $1,000 to $50,000. To qualify, homeowners must have a bank account and be current on their mortgage. This new program will rely on trusted, vetted professional contractors to refer clients to the HomeGreen application after generating a scope of work, which clients must first approve. Those interested can learn more and get started via our application form – available in English y Spanish.

Community resources like these are essential for LMI households, which often spend a large portion of their income on utilities and are especially vulnerable to rising monthly energy bills. While clean energy project costs have dropped significantly, green home improvements remain financially out of reach for many homeowners. Without access to affordable solutions, families are often left with no choice but to turn to predatory lenders or reside in inefficient and potentially unhealthy living conditions. Programs like HomeGreen provide a crucial alternative, offering sustainable, cost-saving upgrades that empower families to reduce their energy burden without falling into debt.

Acerca del fondo Capital Good

Fondo de Bienes de Capital is a Rhode Island-based nonprofit social change organization that uses financial services to tackle poverty and environmental injustice in America. Capital Good Fund offers financing, low-interest loans, and one-on-one financial coaching for the lower-income residents of Rhode Island, Texas, Illinois, Florida, Delaware, Massachusetts, New Jersey, Georgia, Connecticut, Pennsylvania, and Colorado. Since their founding in 2009, they have financed more than 16,000 loans totaling over $50 million with a 97% repayment rate and graduated over 2,000 people from their Coaching program. More at GoodFund.us.