Providence-based nonprofit CDFI is helping low-and-middle income families avoid predatory lenders in 11 states by financing loans and offering financial coaching

PROVIDENCE (February 10, 2024) – Fondo de Bienes de Capital is marking its 15th anniversary. The nonprofit CDFI lender founded February 10, 2009 is dedicated to creating pathways out of poverty, addressing predatory lending, expanding access to green energy, and supporting immigrants on their path to citizenship. It serves low- and moderate-income (LMI) families in Rhode Island, Texas, Georgia, Illinois, Florida, Delaware, Massachusetts, Colorado, New Jersey, Connecticut and Pennsylvania.

“We’re growing and connecting with a lot of external events that align with the path we want to pursue towards ending poverty,” said Capital Good Fund Founder and CEO Andy Posner. “We’re proud of the impact we’ve had and the lives we’ve changed. We’re enabling LMI people to save money and improve their credit scores, while providing equitable loans to help them meet their goals whether it’s making a security deposit to get into a safe apartment, avoiding deportation, or making their home more energy efficient.” Capital Good Fund has financed over 14,000 loans or leases totaling more than $42 million with a 97% repayment rate. The average Good Fund interest rate is 8.15 percent, far more reasonable than the interest rates of predatory lenders, which average 250 percent to 450 percent, depending on the state and the product.

Capital Good Fund has several innovative programs taking on difficult issues ranging from climate change to immigration. The organization launched the pilot of their Georgia BRIGHT (Building, Renewables, Investing in Green, Healthy, Thriving Communities) solar leasing program to expand solar access for LMI families. This program is possible because the Inflation Reduction Act allows nonprofits to use tax credits to reduce the cost of solar panels for low to moderate-income homeowners. The program is expected to be expanded to other states later this year.

Capital Good Fund recently expanded their national immigration lending program to Pennsylvania, with the support of Asociación Estadounidense de Abogados de Inmigración (AILA). AILA members, immigration firms, and nonprofits have the benefit of offering an affordable financing option to their clients who otherwise would be unable to pay for these services.

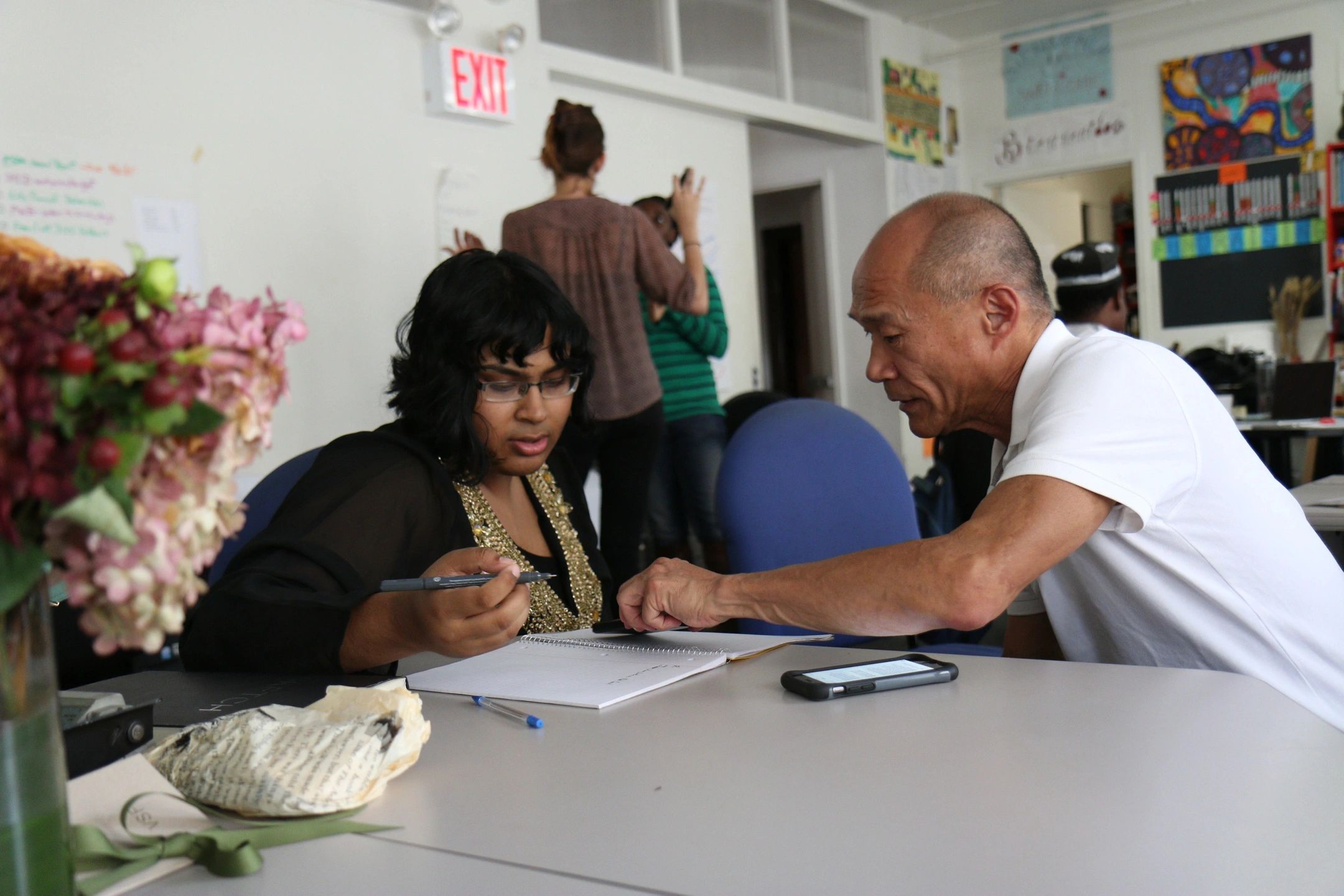

Capital Good Fund also offers a nationally recognized Financial and Health Coaching program to help clients establish a financial plan that enables the achievement of life goals. It has graduated over 2,300 people from its credit building and coaching programs.