The Wells Fargo Foundation Invests $400,000 in Capital Good Fund Financial Coaching Programs

Funds Will Help Nonprofit Lender Support Families Struggling Financially in Texas, Florida, New Jersey, and Connecticut

RHODE ISLAND, January 10, 2023 – Inflation, rising fuel prices and a possible recession are taking a toll on low-income families. The Wells Fargo Foundation is providing $400,000 to Capital Good Fund so they can offer affordable Financial Coaching resources to 500 low-income families in Texas and three other states.

“Financial coaching sets people up for success and helps break the cycle of generational poverty,” says Capital Good Fund founder and CEO Andy Posner. “We are grateful to Wells Fargo for their support.”

Capital Good Fund is a nonprofit, U.S. Treasury-certified Community Development Financial Institution (“CDFI”) that provides financial coaching and equitable loans to low-to-moderate income families for a variety of key needs, including [challenges brought on by the pandemic, immigration expenses (citizenship applications, green card renewal, family petitions, etc.); security deposits; and other emergencies.

The grant funding from The Wells Fargo Foundation will allow Capital Good Fund to expand access to financial coaching to families throughout Houston; Miami; Naples, Florida; Newark, New Jersey; and Connecticut. The grant also enables the organization to offer participants a cash incentive or program cost-matching incentive upon completion. Those interested can use a Coaching Eligibility Checker to find the Financial Coaching Program that best matches their needs and location.

“The last several years have devastated many families and we need deliberate interventions to help put people back on a path to financial stability,” said Bonnie Wallace, head of Financial Health Philanthropy at Wells Fargo. “The one-on-one financial coaching and credit-building, small dollar loans provided by Capital Good Fund can go a long way towards helping people reduce their debt, improve their credit scores, save for emergencies and start building wealth.”

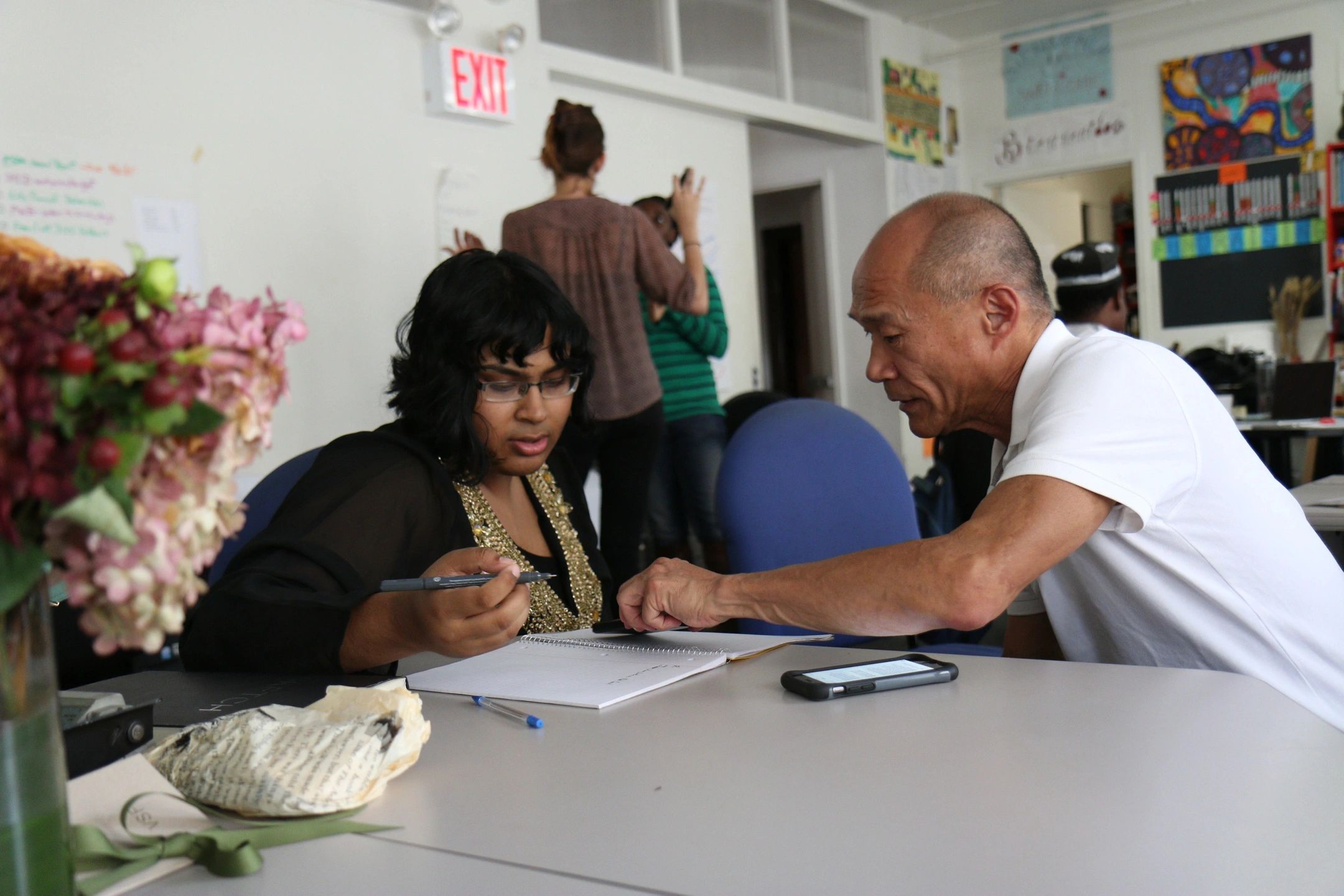

“Our coaching programs help clients build credit, reduce financial stress, learn to maximize their budget, and improve overall well-being,” said Capital Good Fund Director of Financial Coaching, Isabel Ramsay. Nearly all of Capital Good Fund’s coaching clients are low- or moderate-income people.

For example, Capital Good Fund Financial Coaching client, Jessica Vega, wanted to go back to graduate school, but was struggling to pay off her undergraduate loans. “Before I started, I was working two to three jobs to make ends meet. The coaches were non-judgmental and willing to work with me. They did not say ‘shame on you,’ but ‘how can I support you’,” Vega recalls. “They gave me the tools I needed to get my life in order.” Vega has since paid down her undergraduate loans, got her financial aid reinstated and earned a master’s degree in Community Development earlier this year. She is working as a program director for Social Enterprise Greenhouse and is hoping to buy a house next year.

About Capital Good Fund

Capital Good Fund is a Rhode Island-based nonprofit social change organization that uses financial services to tackle poverty in America. Capital Good Fund offers one-on-one Financial Coaching and Loans for the lower-income residents of Rhode Island, Texas, Illinois, Florida, Delaware, Massachusetts, Colorado, New Jersey, Connecticut, and Georgia. Since its founding in 2009, they have financed over 12,000 loans totaling $25 million with a 95% repayment rate and graduated over 2,300 people from its credit building and coaching program. Learn more at www.GoodFund.us.