The Pennsylvania BRIGHT (Building Renewables & Investing for Green, Healthy, Thriving

Communities) program uses the Inflation Reduction Act to help residents save money on utilities

Philadelphia, Pennsylvania (August 12, 2024) – A quarter of low-income households in Philadelphia spend more than 19% of their income on energy bills, which is almost 6 times higher than the city’s median energy burden according to the American Council for an Energy-Efficient Economy.

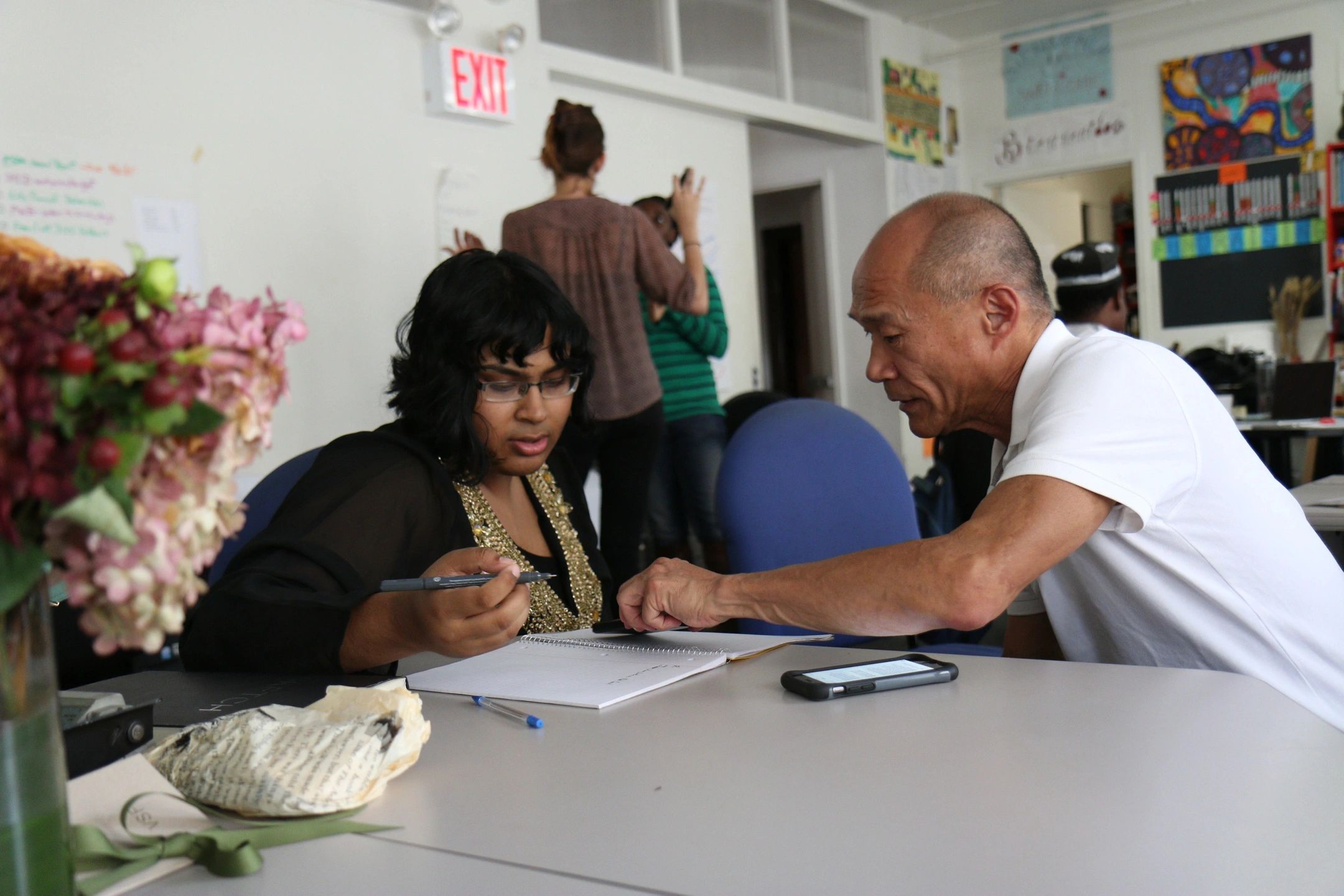

Just in time for Philadelphia Solar Week, nonprofit CDFI Capital Good Fund is announcing its partnership with Philadelphia Green Capital Corp (PGCC) and Solarize Philly to expand solar leasing options for low and middle-income (LMI) families through the launch of the Pennsylvania BRIGHT solar lease pilot. Sixty LMI homeowners in Southeast Pennsylvania will be able to lease solar systems that Capital Good Fund owns and maintains. The average family stands to save 20% on energy costs every month, net of the lease payment.

“Increased access to renewable energy is essential to easing the disproportionate energy burden LMI families carry,” says Capital Good Fund founder and CEO Andy Posner. “If no one is giving them the opportunity, you’re increasing that income gap, because only the wealthiest people will access renewable energy and further increase their wealth profile.” Pennsylvania is the second state to benefit from this program, which was successfully launched in Georgia last fall.

Pennsylvania BRIGHT is available to LMI homeowners in Philadelphia County as well as Bucks, Chester, Delaware, and Montgomery, Counties. To be eligible, the homeowner’s gross annual income must be less than $100,000 or the homeowner must reside in a disadvantaged census tract as identified by the Climate and Economic Justice Screening Tool, linked here. These income and geographic limits allow the program to focus on homeowners who have the most to gain from solar energy and the least ability to finance initial costs. “Because it is a lease program, there is no upfront cost and families do not pay to install or maintain the panels,” says Alexis McCarthy, Pennsylvania BRIGHT Program Director. The program is possible because the Inflation Reduction Act allows nonprofits to reduce the cost of solar panels for LMI homeowners using tax credits.

The launch of Pennsylvania BRIGHT is made possible by receiving financial support and through local partnerships, including Philadelphia Green Capital Corporation (PGCC), the green bank in Southeast Pennsylvania. “PGCC is here to develop new financing tools that expand access to clean energy for people of all incomes, and we’re excited to bring Capital Good Fund’s product into our market. It lets our local solar installers offer an attractive, consumer-friendly way to pay for solar with no upfront cost, no ongoing maintenance costs, and no need to take out debt,” said Maryrose Myrtetus, Executive Director of PGCC.

“We’re thrilled to bring the Pennsylvania BRIGHT pilot on board,” says Tabeen Hossain, Senior Manager of Residential Programs at Philadelphia Energy Authority (PEA), the organization that operates Solarize Philly. “Capital Good Fund will be working with our Solarize Philly installers to offer a new financing option and bring solar to 60 low-income households.” As part of the Solarize Philly program, the installers will provide employment opportunities and training within the very same LMI communities in which the solar systems are leased.

Pennsylvania BRIGHT also received funding support from the BQuest Foundation. “We are delighted to support Capital Good Fund as they bring their successful Georgia BRIGHT program to Pennsylvania families,” said Kathlyn Mead, Chief Impact Officer of the BQuest Foundation.

For more on this program, visit the homepage.

About Capital Good Fund

Capital Good Fund is a Rhode Island-based nonprofit social change organization that uses financial services to tackle poverty and environmental injustice in America. Capital Good Fund offers financing, low-interest loans, and one-on-one financial coaching for the lower-income residents of Rhode Island, Texas, Illinois, Florida, Delaware, Massachusetts, New Jersey, Georgia, Connecticut, Pennsylvania, and Colorado. Since its founding in 2009, it has financed 16,000 loans totaling over $46 million with a 97% repayment rate, and it has graduated over 2,000 people from its coaching program. More at www.GoodFund.us.

About Philadelphia Green Capital Corp (PGCC)

The Philadelphia Green Capital Corp. connects projects to public, private, and philanthropic capital to drive a robust, equitable clean energy market in the Greater Philadelphia region, support the Philadelphia Energy Authority, and respond to the local challenges of climate change. Learn more at phillygreencapital.org

About Solarize Philly and Philadelphia Energy Authority (PEA)

Solarize Philly, a citywide initiative to help all Philadelphians go solar, and is run by the Philadelphia Energy Authority (PEA). PEA is an independent municipal authority focused on building a robust, equitable clean energy economy for Philadelphia. Launched in 2016, PEA leads the Philadelphia Energy Campaign, a $1 billion, 10-year investment in energy efficiency and clean energy projects to create 10,000 jobs. To date, PEA and its affiliate, PGCC, have supported over $900 million in projects and created more than 7,600 jobs. Learn more at www.philaenergy.org.