Capital Good Fund Now Offering Immigration Loans in Georgia

Nonprofit CDFI expands into its tenth market thanks to partnership with American Immigration Lawyers Association

Providence, Rhode Island – Immigrants in Georgia have a new financial resource. Tens of thousands of Georgians seeking to improve their immigration status face a barrier to economic mobility: the need to come up with as much as $20,000 to pay for necessary legal and filing costs. Capital Good Fund and the American Immigration Lawyers Association (AILA) launched a statewide program that allows AILA member-attorneys in Georgia to offer an affordable financing option to their clients who otherwise would be unable to pay for these services. The program is also available in New Jersey, Connecticut, Florida, Texas, Colorado, Illinois, Rhode Island, Massachusetts, and Delaware, with plans to expand to additional states throughout the year. Capital Good Fund is a nonprofit, U.S. Treasury-certified Community Development Financial Institution (CDFI) lender that provides equitable loans to lower-income families for a variety of key needs on top of immigration expenses, such as making energy upgrades to their homes (e.g., solar panels and high-efficiency appliances); COVID-19 related costs; making security deposits, and more.

“Immigrants shouldn’t have to choose between putting food on the table and pursuing their American Dream,” says Andy Posner, Capital Good Fund founder and CEO. “As AILA’s Preferred Immigration Loan partner, we’ve been able to grow the impact that these loans have on immigrant lives around the country and we’re excited to now be available to communities in Georgia. With nearly 500 immigration attorneys and over one-million immigrants, Georgia is an especially high-impact market for us to serve.” Through working with AILA members and their clients, Capital Good Fund can help with an array of legal costs for those looking to improve their immigration status, including applying for citizenship, a green card, or asylum; petitioning family members; fighting a deportation order, and other costs that can become insurmountable after filing fees and high-quality legal representation.

Capital Good Fund’s first loan in April of 2009 was for $875 to cover citizenship costs for a low-income Providence resident. Since then, they have financed over 450 immigration loans worth more than $2 million for a variety of immigration cases and expenses.

AILA President Allen Orr, Jr., noted, “Having an AILA member attorney as your advocate during immigration proceedings can make all the difference. We know that access to financial resources can be extremely difficult for many individuals who need the assistance of qualified counsel. Capital Good Fund has been working with AILA chapters since 2016 when the organization expanded its services to Florida, and we are excited to partner with them as they continue to increase their reach and allow more people to access legal representation.”

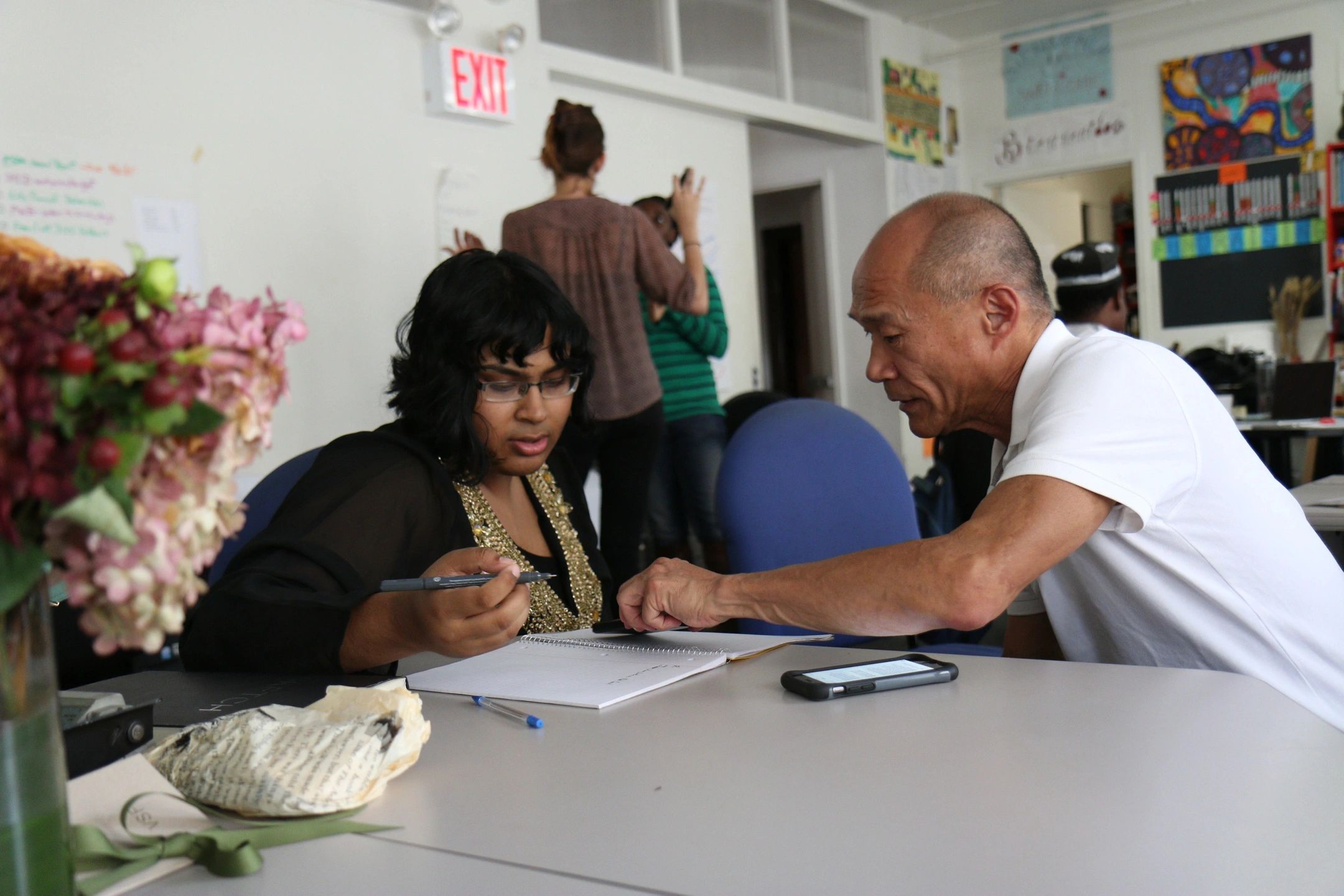

In just a few months since launching in Connecticut in February, the Capital Good Fund Immigration Loan program is already having a strong impact on Hartford, Connecticut-based Pichardo Immigration Associates LLC. “This is a game-changer. My clients know they need an attorney because immigration law is very complex, but they aren’t making much money and it is hard for them to save,” says founder, CEO, and AILA member Rafael Pichardo. “Low-cost loans are exactly what they need. I explain to them that getting a loan for something as important as this is going to pay dividends for the rest of their lives.” Pichardo says the loan program also allows immigration attorneys to spend more time working on cases and less time collecting money from clients. Pichardo immigrated to the United States from the Dominican Republic when he was six years old and became a U.S. citizen eleven years later.

Capital Good Fund granted Ana Marcia of Providence, RI a loan so she could pay the $5,000 cost—attorney expenses and USCIS filing fees—of a work permit, which had the immediate benefit of allowing her to get a driver’s license and helped her build her credit. “No other bank gave me the same opportunity Capital Good Fund did,” she remembers. “I felt disillusioned. I didn’t see a way to get the work permit. Getting the permit made me feel that ¡sí se puede! – it can be done!” The impact of the loan went beyond her getting a work permit: in turn, she was able to not only launch her own cleaning business but to buy a home for her family of four, the last made possible by the fact that she established and then built her credit score.

About Capital Good Fund

Capital Good Fund is a Rhode Island-based nonprofit social change organization that uses financial services to tackle poverty and environmental injustice in America. Capital Good Fund offers low-interest loans of up to $60,000 and one-on-one Financial Coaching for the lower-income residents of Rhode Island, Texas, Illinois, Florida, Delaware, Massachusetts, New Jersey, Connecticut, Colorado, and Georgia. Since the COVID-19 crisis began, Capital Good Fund has closed nearly 3,000 COVID-19 Crisis Relief Loans of $300 – $1,500 with a five percent APR and a three-month deferment period. Since its founding in 2009, they have financed over 9,500 loans totaling more than $21 million with a 95% repayment rate and graduated over 1,800 people from its Coaching program. More at www.GoodFund.us.

About American Immigration Lawyers Association (AILA)

The American Immigration Lawyers Association (AILA) is the national association of more than 15,000 attorneys, paralegals, law professors, and law students who practice and teach immigration law. AILA member attorneys represent U.S. families seeking permanent residence for close family members, U.S. businesses seeking talent from the global marketplace, as well as foreign students, entertainers, athletes, and asylum seekers. Founded in 1946, AILA is a nonpartisan, not-for-profit organization that provides continuing legal education, information, professional services, and expertise through its 39 chapters and over 50 national committees.